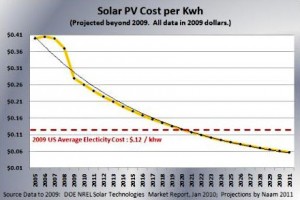

Recently other parts of the grown-up blogosphere woke up to the implications of a fact which alert RBC readers will have known for some time if they´ve been Paying Attention. To wit, that solar PV has been growing at breakneck speed for the last decade, driven by an almost equally rapid fall in prices. If this continues, solar electricity could well become the cheapest generating technology as early as 2020.

Solar has written the doom of coal on the wall, and probably oil, not

a moment too soon. It couldn´t happen to nastier industries. Paul Krugman; Kevin Drum; an even more optimistic take here. Here´s Kevin´s extrapolation, a little different from my paper exercises, but the same story:

What surprised me was this put-down from economist Tyler Cowen (his italics):

… The real question is whether we see industry-wide price changes as would befit a systematic solar energy revolution.Is there any reason, based in industry-wide market prices, to be optimistic about the near-term or even medium-term future of solar power? I don’t see it.

You´d be hard put to find a better illustration of the old chestnut about the EMH economist whose friend tells him there´s a banknote lying in the road:

Can’t be. If there was a bill on the ground, somebody would have already picked it up.

Where to begin? Most normal people would say: that´s another nail in the already well-sealed coffin of the EMH. But faced with indisputable facts about solar market prices and installation quantities, Cowen´s response is: where´s the solar boom or fossil bust in asset prices? He can´t see one, so the facts must be wrong, or more politely epiphenomenal noise. Note that the objection is not based on any falsifiable hypothesis about solar PV, such as: Germany will have to cancel its solar PV feed-in tariff as unaffordable, silicon feedstock supply will hit a new bottleneck like the one that kept prices from falling in 2004-2008, solar PV will turn out to cause cancer, impotence and obesity or at least will be thought to do so. (Now there´s a hot tip to the oil industry PR men: work up some scares.) For the record, while Germany did reduce its feed-in tariff, China has announced one.

However, simply asserting the primacy of facts over speculation will not do. You have to sauce the data with a theoretical narrative.

1. The global solar PV business is extremely competitive (good news, in spite of numerous casualties like Solyndra). There are plenty of suppliers at each stage in the chain. No single company has a monopoly, or even a serious edge in technology. This by itself makes an asset bubble unlikely; it´s impracticable to pick likely winners, and bubbles are not driven by prudent, diversified portfolio investors. To a first approximation, solar PV wafers, modules and panels are manufactured quasi-commodities, like fridges and DVD players. It´s also important that this is a global industry, even though China is coming to dominate the wafer end. Its growth and technological advance is less and less dependent on policy vagaries in any one country. The USA in particular is very much a second-division player.

2. Because it´s growing so fast, and installation demand is sensitive in the short run to unpredictable policy changes in key markets, the solar PV industry is prone to short-run cycles of over-and under-capacity. At the moment, it´s overcapacity, and stock valuations are down. So what? The cycles tell you nothing about the trend.

3. Solar energy, like wind, is paradoxically not a natural resource industry. Over a 50-year horizon at least, there are no serious constraints on the energy sources. (Brett, I recognize that wind runs into problems of interfering with weather patterns when you get up to tens of terawatts.) The same goes for the inputs: sand and tiny amounts of rare earth dopants for solar; steel and a little hydrocarbon resin for wind. Hydro does face natural resource constraints, and so does geothermal a long way down the road. For practical purposes, the production of solar and wind generators are manufacturing industries.

That is, their general production function is characterised in the medium run by constant returns to scale. You can expand supply at the same cost by building identical new factories and training new workers without practical limit. By Econ 101 principles, you would not expect to see significant price changes in such industries other than those driven by improvements in technology, and short-run cyclical ones which most manufacturers prefer to replace with queuing and promotions. If you´d been trying to observe the personal computer or mobile phone industries recently, or the refrigerator and car industries in the 1930s, or railways in the 1870s, just by looking at the unit prices, you would have missed most of the action, which was in the quantities shipped.

Both solar and wind energy are also demonstrably characterised by impressive economies of scale from learning; nuclear power, the reverse. There is no reason to think that any of these trends will stop any time soon. In solar, the principal avenue is reducing the high cost of feedstock of appropriate purity, rather than struggling up a diminishing-returns curve, as Solyndra did, to wring out increases in conversion efficiency.

4. The absence of reaction in the asset and commodity markets for

fossil fuels does not prove that their doom is not written. First, the

projection of current trends only suggests that solar PV will be cheaper

than fossil for electricity generation in 10 years´ time. Meanwhile,

oil in particular will have a fantastically profitable Masque of the Green Death.

The usual myopic effects of commercial rates of discount are reinforced

by the incentives on managers to have an even shorter horizon. You

won´t see oil companies´ stock prices fall for a good while yet. Coal?

Sooner I think; as renewables provide electricity, coal´s only market,

while substitution for oil in transportation has to overcome the battery

bottleneck for cars, and nothing´s in sight for aviation. The

going-out-of business party will be terrific, though I do hope they

don´t take this approach to downsizing the clerical help:

5. There is something deeply weird and misguided about giving cognitive priority to prices over quantities. Any economic transaction involves both a price and a quantity. So economics as the study of such transactions must look at both. But I´d go much further than this truism. Prices belong to the universe of information; they are signals about reality. That reality consists, for the economist, in stocks of assets, workers and knowledge, and flows of labour, goods and services. These stocks and flows exist in the physical universe of matter, independently of the price that may or may not be attached to them. It is these flows alone that create utility. A Leontief input-output matrix using incommensurable physical units – tonnes for steel, kwh for energy, hours for labour – is a useful if limited tool for understanding. A matrix of prices without quantities to attach to them is useless.

One of the functions of economics as a science is to allow its students to tear the veil of money illusion and see this real world of utility beneath the epistemic flux and foam of transactions. You don´t have to endorse the false labour theory of value to assert that quantities are ontologically prior to prices. If that´s Puritan fundamentalism, I say: sign me up, John Calvin.

Apologies to Poe for ripping off the title of his great story.

Logging you in...

Logging you in...

Loading IntenseDebate Comments...

Loading IntenseDebate Comments...

NCG says

(Edit)

You mean we aren’t going to bake the planet???

From your lips to God’s ears!

liberal says

(Edit)

I thought the big problem with solar is storage—you can’t run it directly when the sun isn’t shining, and storage technology pretty much sucks right now.

dave schutz says

(Edit)

I think this graph reifies a trend – and you could well get to a place with constant returns to scale and plateau at any time, including well before you drop below current fossil fuel costs. So – it’s nice, hope you are right that it will go on, but time will tell.

James Wimberley says

(Edit)

Why should we think this? Technologies have characteristics; cf. Moore´s Law for microcircuits. The persistence of a trend is more probable than a discontinuity. Don´t you expect next year´s laptop to be more powerful or cheaper than this year´s? The plateau for solar will come I suppose when silicon ingots can be made using an essentially metallurgical process at $5 a kg, not by vapour deposition at $50.

dave schutz says

(Edit)

McMegan is with me on trend extrapolation: http://www.theatlantic.com/business/archive/2011/11/should-we-be-bullish-on-solar/248608/ and is worth reading.

James Wimberley says

(Edit)

Nice to be noticed, even by a paid

journalistpundit who can´t be bothered to get my name right. (Hint: it´s printed just below the title of the post). Her only substantive point is about the installation costs. These have, as it happens, also been fallingin line with module prices. Her sneer that Greens should logically stop campaigning now that a technical solution is in sight is a contemptible cheap debating point. There´s a lot of work to do, especially in the US, to ensure that the market is ready for cheap solar; and of course, the rapid progress still depends on the maintenance of subsidised feed-in tariffs in China and Europe (the US outside California being determined to stay a free rider). Why should I or you look to her for reliable information on technologies for energy storage?Barry says

(Edit)

McMegan’s errors have been extensively documented. Nothing she says is trustworthy (including her citations and math).

j r says

(Edit)

This is a very strange line of argument. The future extrapolation of a present trend is certainly worth paying attention to, but it is not an ” indisputable fact.” In fact, since Cowen is disputing it, your use of that phrase is, on its face, wrong.

James Wimberley says

(Edit)

The indisputable fact is the past trend, which rode right through the recession.

Dave Schutz says

(Edit)

Here’s your silicon process improvement: http://www.technologyreview.com/energy/39157/?p1=A4 suggests I should hold off for a few years on my rooftop solar, but eventually come on board. I still think this kind of stuff comes in lumps, not smooth lines, and sometimes is possible and sometimes not. “I don’t always obey the laws of Virginia, but I always obey the laws of physics”.

Keith Humphreys says

(Edit)

James: This is extremely interesting and inspiring as well. I hope you are right about the rise of solar. My understanding of world coal reserves is that the majority are in Russia, China and India — which makes me think they are going to be used regardless of what other technologies emerge.

p.s. Language question about the “old chestnut”…are there new chestnuts?

James Wimberley says

(Edit)

A plausible etymology for the phrase here. They must be old.

If coal is more expensive, why should these countries continue to burn it? Australia and Canada aare sitting on the world´s best uranium reserves, but that hasn´t made them build waves of nuclear power stations. The Chinese introduction of a feed-in tariff for solar is very strong confirmation that China, for one, is serious about reducing its (still rapidly growing) carbon emissions and moving away from coal. Coal burning also produces serious and politically dangerous local and regional pollution. Russia may turn out to be a problem because its population centres are so far north, but it´s a small part of the world economy.

Barry says

(Edit)

“If coal is more expensive, why should these countries continue to burn it? Australia and Canada aare sitting on the world´s best uranium reserves, but that hasn´t made them build waves of nuclear power stations. ”

Existing physical, economic and corporo-political infrastructure would be my guess.

Keith Humphreys says

(Edit)

If China is so serious about carbom emissions, why didn’t it (and India) sign the Kyoto Protocol? Both countries also have huge rural populations who exist with no high power lines around…and of course, there are cloudy days.

James Wimberley says

(Edit)

China: Nationalism. The objection was and is to the supranational elements of the Kyoto regime and its proposed successor, not to reducing emissions. You have me on India.

Brian Schmidt says

(Edit)

India and China did sign and ratify Kyoto:

http://en.wikipedia.org/wiki/List_of_Kyoto_Protocol_signatories

If the question is why didn’t they go further and permanently commit themselves to one-fifth/one-third of the per capita emissions of the US, then I think the question answers itself. They both have committed to never match or exceed US per-capita emissions, and received only condemnation from American denialists/delayers.

Anonymous37 says

(Edit)

“A plausible etymology for the phrase here.”

Sorry – that page isn’t available…

That may be for a variety of reasons:

– You followed a broken or out-of-date link.

– You entered the URL for the page incorrectly.

– The page no longer exists.

Please try one of our other links in the left-hand menu.

If you would like to report a broken link, please contact admin@phrasefinder.co.uk.

Bloix says

(Edit)

A chestnut is a tree. An old chestnut is a well-known story or joke. It’s an idiom, not a redundancy.

valuethinker says

(Edit)

Keith

The largest coal reserves are in:

- China

- Australia

- USA

I think India and Russia are numbers 4 and 5.

The other biggies would be Canada, Columbia, Indonesia. If we include Lignite then Poland is in there, too.

Metallurgical coal there could be real shortages. Thermal coal never.

Ebenezer Scrooge says

(Edit)

Keith,

I thought that the US was the Saudi Arabia of coal. This doesn’t negate your point, at least until the cost of coal extraction in a poor country is greater than the cost of manufacturing renewables.

James,

Great post, but I’ll make two caveats. There is no battery technology I know of that promises to have anywhere near the energy density of hydrocarbons. I don’t think that we’ll get rid of oil/gas for transportation until we can store renewable energy in a covalent chemical bond: hydrogen, hydrocarbons, or whatever. The other point is that we can’t stop burning carbon for electricity until we get some reliable baseload power. Except for hydro (which is mostly exploited by now), no renewable will serve. We’ll either have to rely on nukes (which I’m gradually becoming disenchanted with) or figure out how to store vast quantities of energy by, e.g., pumping water uphill, storing solar in covalent bonds, whatever.

Keith Humphreys says

(Edit)

Ebeenzer, we do indeed have a pile of coal (India, Russia, China and USA have together 90% of world reserves I believe). I left us out of my comment though because I think we are much more likely to adopt solar technology on a broad scale than are the others.

Ebenezer Scrooge says

(Edit)

1. Bad thermodynamics, unless you can get the rocks really hot, or find natural hot rocks near the surface, as they do in Iceland.

2. Some systems can live without 100% reliability; others can’t. Hospitals are a prime example of a system that absolutely positively must be 100% reliable. There is no reason we can’t have a slightly unreliable grid. But depending on the degree and nature of unreliability, we might need a fairly large number of backup generators that must burn something.

3. Hot salt can work as storage, and doesn’t require temperatures as high as rocks. But chemical storage is potentially far more efficient thermodynamically, and works well for transportation.

4. Yes, but I forgot to mention something. Current technology (a double entendre) limits electricity transmission to 400 miles or so. The Great Plains is Big Wind. We might get its juice to Chicago, but not much further east. One of these days, we’ll get a practical superconducting transmission line. But not quite yet.

Again, I’m not arguing with what I think is your main point: photovoltaic and wind are NOW, and fossil fuel is on its way out. And your takedown of Cowen was masterful. But a thorough nonfossil infrastructure is still in the future, and probably relies on technological development.

Dave Schutz says

(Edit)

I hope James Wimberly is right. One storage system which is worth thinking about is the batteries in parked cars: to the extent that cars get charged from solar sitting in suburban driveways, that can spare hydrocarbons, and make fossil fuel available for the long haul trips for which electric cars are least useful. But I’ve seen a lot of trends which people think have life and power as forcing change (‘the Dems will control the House for as far as the eye can see’, ‘Illegal Immigrants on track to swamp American institutions’, ‘Napster will destroy the recording industry’) and which turn out to be composed of granular individual decisions/events which don’t go in a smooth trendy way.

koreyel says

(Edit)

Along these lines:

http://www.newscientist.com/article/mg20928025.700-smartgrid-stockbrokers-to-manage-your-power.html?

valuethinker says

(Edit)

“4. Yes, but I forgot to mention something. Current technology (a double entendre) limits electricity transmission to 400 miles or so. The Great Plains is Big Wind. We might get its juice to Chicago, but not much further east. One of these days, we’ll get a practical superconducting transmission line. But not quite yet.”

Ever heard of Hydro Quebec La Grande 1,2,3,4?

They move electricity over 1000 miles to New York City.

So it’s news to Quebec Hydro, and Conn Ed, that electricity only wheels 400 miles.

Your problem, I suspect, is that like a lot of Americans you think AC. But long distance power transmission is DC.

From memory the Russians and the Brasilians both have transmission lines over 1500 miles.

Keith Humphreys says

(Edit)

What does it matter if your freezer or car battery charger stops for an hour in the middle of the night?

If that were all that happened, it would be a reliable (e.g., predictable) system – so I think you need to take on what unreliability could look like, electricty goes out when a flight controller is trying to land a 747, or when a nursing home is facing half the residents dying during a heat wave, or at rush hour in downtown manhattan.

James Wimberley says

(Edit)

Extreme examples don´t hack it. Of course there´s a subset of uses, even in a house, where interuption isn´t acceptable; many others, including the heavy uses (space heating and cooling) where it is. But a variable supply above a minimum is manageable with intelligent prioritising controls. An intelligent grid, coupled to intelligent customer controls, drawing on a greater number and variety of sources of supply, can surely manage with a much much lower guaranteed base supply than we assume today. Also worth noting that we already have a large switchable reserve in the form of the legacy gas-fired stations. Anyway, it´s these minor inconveniences vs. the planet.

Maynard Handley says

(Edit)

James, it seems to me you’re assuming a screwdriver.

Yes, IF we had an intelligent grid, then various things would be possible. But the same forces that prevent us from limiting our numbers, or rationalizing our public transit system, or (even in places with severe water shortages) running separate pipes for clean and gray water, prevent us from building an intelligent grid. You can’t simply claim that the grid problem will just be solved when it needs to be.

And people’s response to flaky grid power is NOT to just accept it. Visit the city of Yangon some time. It is absolutely freaking unbelievable. The public grid is untrustworthy, so EVERY city block has a container-sized cheap Chinese diesel generator sitting somewhere on it, and I assume with some local deal with the people living on the block paying for power — it’s like something out of Mad Max.

Yes — if we get a perfectly intelligent grid, such that, when power available dips it is the car chargers and (perhaps, for a limited time, the refrigerators) that lose power, people will accept it. If it is also the TVs, and the computers, and the lights, and the microwave ovens, that lose power, people will adopt whichever is cheaper of

- voting out whoever insisted on this flaky electrical system

- flooding the land with lead-acid storage batteries or

- installing cheap Chinese diesel home generators.

valuethinker says

(Edit)

Maynard

What’s the price of diesel fuel in Yangon? 50 cents a litre? In Baghdad it’s about 20 cents a litre I think.

World market price (UK heating oil price- -heating oil attracts no duty) is 80 cents. a litre (c. 55p).

UK domestic price of diesel is £1.40/litre or about $2.10/litre, c. $8.00/ US gallon (3.8 litres in a US gal).

So you see the problem. People may source backup generators, but even if untaxed they won’t run them all the time.

And home generators make huge amounts of noise.

People *will* run them: to run air conditioning. That’s a given. Everything else, they’ll find more efficient ways of using power before they run them.

A 100% solar power electrical system is an abstraction. And if we had such, we’d add massive amounts of pumped hydro etc. to the grid.

But a 20% solar PV system, with strong interlinkages, with pumped storage… it’s all quite possible.

James Wimberley says

(Edit)

1. I already blogged about hot dry rocks.

2. Learning to live without 100% reliability. What does it matter if your freezer or car battery charger stops for an hour in the middle of the night?

3. Hot salt.

4. Balancing solar with wind´s variability: to a comsiderable extent, they complement each other.

Barry says

(Edit)

One of the lessons I’ve taken from the current crisis is that right-wing economists are just that. They may function well day-to-day, and occasionally have attacks of conscience, but in the end they’ll choose ideology over reality.

Betsy says

(Edit)

The storage problem for vehicles will lessen as governmental budget contraction reduces the road-building subsidy for sprawl, and persons and firms respond to the reduced subsidy by returning to central places instead of extending their daily supply chains across multiple counties. Fewer vehicle miles and higher potentials for normal transportation (non-personal-automobile) will reduce the storage needed.

James Wimberley says

(Edit)

I post a semi-pornographic image of a suicidal orgy with naked women being stabbed by crazed Orientals, and commenters write about coal and batteries! Only at the RBC.

Ebenezer Scrooge says

(Edit)

Oh, so that was the nature of the excess bandwidth in your post!

Anonymous37 says

(Edit)

Um, James, when we write “coal”, we’re using its common meaning: “crazed Orientals stabbing”; when we write “batteries”, we mean “naked women”; and when write “solar energy”, we mean “suicidal orgy”. What comments thread are you reading?

paul says

(Edit)

I think that for market reaction times we can look at the housing bubble. It was four years after the first discussions of bubbles that valuations for some of the firms at risk started trending downward, and two years after pretty much everyone was agreed that it was a bubble (when you start saying “I’ll be gone, you’ll be gone” and letting the bears choose what you sell to the bulls, that’s pretty much everyone).

Add to that the uncertainty of the downward-sloping solar curve, the capital cost of replacing facilities, and the huge piles of money that can be made by holding out another year/quarter/week/hour and then selling out to a less-clued-in sucker, and whee.

Let’s also remember that oil and coal are priced nowhere near extraction cost these days, so as solar starts replacing significant chunks of demand we can expect to see peak-oil price explosions simply moderating rather than crashing. There’s plenty of profit left in the old model. But none of that is what Cowen was saying.

Meanwhile, concerns on the storage side seem overblown to me. We’ve got a catchment area 3 time zones wide and 20 degrees of latitude high, and loads that are considerably higher during the day than the night. And plenty of renewables that run fine during the night or when there’s no wind. And battery power that’s already comparable to peaking generator cost.

Sebastian H says

(Edit)

“But a variable supply above a minimum is manageable with intelligent prioritising controls.”

But a variable supply that is completely unavailable at night and largely problematized during the winter is still pretty tough.

Maybe not impossible. But not to be waved away…

TallDave says

(Edit)

I think the best way to look at this is the way one of Tyler Cowen’s commenters did:

If solar panel prices fell to zero, what would demand look like?

Unfortunately, the answer is: not that good. People place a very high premium on power being on all the time, and storage is not getting cheaper anywhere near as fast. Plus, there are too many other costs than the panels themselves, and their plant power density is extremely poor even at the theoretical maximum, which isn’t all that far off.

So solar PV mostly only works well for air conditioning peak power, because that’s where demand coincides with daytime. That means unless you live somewhere near the equator, for about 3/4 of the days of the year it’s not very useful… and there’s the problem of hot, cloudy days (yes, the power drop isn’t big, but if drops 10% you need to have 10% more around to be sure you can meet peak demand).

But, you have to pay for your solar panels all year, and at night. So, compared to a fossil fuel or nuclear source, on average it’s only about 1/8th as useful (half the day, about a quarter of the days of the year), even before the density problem. That means it has to cost about 1/8th as much, and that won’t happen for thousands of years (about when we use up the last of the easily obtainable fissionables, assuming fusion is still 50 years away).

An intelligent grid, coupled to intelligent customer controls, drawing on a greater number and variety of sources of supply, can surely manage with a much much lower guaranteed base supply than we assume today

Not without pain and expense. Yes, you can shut off people’s AC on cloudy days, no people won’t like that. Storage is expensive. And of course a network like that will have buildout and administration costs, and maintenance that will further impact QoS. Most people would rather use dumb fossil/nuclear and have cheaper, more reliable power.

(Personally, I’m hoping Rossi was onto something.)

valuethinker says

(Edit)

“Plus, there are too many other costs than the panels themselves, and their plant power density is extremely poor even at the theoretical maximum, which isn’t all that far off.”

- commercial solar panels run at below 20% efficiency. Theoretical maximum is c. 60%? Ie 3 times as much?

“So solar PV mostly only works well for air conditioning peak power, because that’s where demand coincides with daytime. That means unless you live somewhere near the equator, for about 3/4 of the days of the year it’s not very useful… and there’s the problem of hot, cloudy days (yes, the power drop isn’t big, but if drops 10% you need to have 10% more around to be sure you can meet peak demand).”

Actually solar power works pretty well in London, 51 degrees North. I am sure the National Grid would love to have say 10% additional power capacity which kicks in 2-6pm on weekdays in the summer.

“But, you have to pay for your solar panels all year, and at night. So, compared to a fossil fuel or nuclear source, on average it’s only about 1/8th as useful (half the day, about a quarter of the days of the year), even before the density problem. That means it has to cost about 1/8th as much, and that won’t happen for thousands of years (about when we use up the last of the easily obtainable fissionables, assuming fusion is still 50 years away).”

– or rather, at $1/watt, solar is at ‘grid parity’ and without subsidy, competitive with electricity delivered by those sources. And in some places, at $3/ watt, it’s already competitive (Italy, Greece, parts of Southern CA etc.).

Fossil is not cheap. Well gas is cheap to build, but not to fuel. Coal is expensive to build: all that capitalized interest expense. Nuclear: the costs of the 3rd Gens keep going up with every new estimate. Getting to $10k/ kwhr, yes, that’s 3 times the cost of solar.

–Basically you are benchmarking 3 highly mature techologies (gas, coal, nuclear) against a relatively mature one, then magicking up a ’1/8th as useful’ number to justify that. Here’s the grift: nuclear gets more expensive with each iteration (why is fascinating, but RBC had a post a while back about it– there do not seem to be learning economies of scale). Add Carbon Capture and Storage to coal or gas, and their prices shoot up 40%.

“Not without pain and expense. Yes, you can shut off people’s AC on cloudy days, no people won’t like that. Storage is expensive. And of course a network like that will have buildout and administration costs, and maintenance that will further impact QoS. Most people would rather use dumb fossil/nuclear and have cheaper, more reliable power.”

– ahh no. You can rotate short cuts of 30 minutes to AC systems, fridges etc. Guess what? Ontario already does that.

Nuclear is not reliable, because it’s subject to unplanned outages. And solar is not yet a mature technology in a cost sense. 10-20 years behind wind, and wind is still going down.

As to storage pumped storage is almost as old as electric power systems.

ferd says

(Edit)

Is it ok to criticize style, here? If so, I’d say keep and up the humor, but almost completely lose the ornamentation — this close to election season.

Eli Rabett says

(Edit)

Three materials related issues

a. Metal refining is an important user of lots of high grade coal (most of the stuff that goes from Australia to China for example). That market ain’t going away.

b. In a similar manner, plastics and commodity chemicals are base users of oil. That is not going to be replaced.

c. Rare earths are a potential bottleneck for solar in the short run. There is a sufficient amount of the stuff, but ramping up new capacity takes time.

dave schutz says

(Edit)

This guy says http://www.futurepundit.com/archives/008429.html that price declines have a lot to do with overbuilding recently, that we are essentially getting dumped panels from people who are trying to keep their plants running. If so, this is something that won’t necessarily go on.