The Reinhart-Rogoff paper on the history of debt crises has been boiled down to a self-fulfilling bond-vigilante creed that countries with a debt-to-GDP ratio of over 100% (like Italy and Greece today) have entered a zone of trouble.

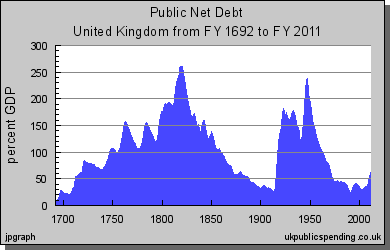

Maybe so. But how then did Britain in 1815 manage a postwar debt-to-GDP ratio that is now estimated at anything from 260% to 290%?

Contemporaries did not of course have any number for GDP, hence the

uncertainty in the retrospective ratio. But they did know exactly how

large the nominal debt was – £854m

– and how much the annual interest burden was – almost 60% of the

peacetime budget. SFIK they managed it perfectly well. There were

regular banking crises and panics in the following half-century, but the

debt interest was paid like clockwork, and default was not on the

agenda. Since the government ran a primary budget surplus, and kept out

of big new wars and new borrowing, so the economic growth of Britain.

industrial hegemon of the world, made the debt less and less of a

problem – until 1914.

Source

How come?

We can rule out genius as an explanation. The Chancellor of the Exchequer from 1815-22, Nicholas Vansittart,

First Baron Bexley, was regarded as a duffer by Brougham, Huskisson

and Ricardo, the sharpest financial brains in the Commons. He just

muddled through.

There were several factors, some not reproducible or desirable.

1. Ruthless plutocracy. Lord Liverpool´s government was very reactionary. Its one social aim was to preserve the rule of the propertied against the unwashed (with no public water supply) and illiterate (with no public schooling) masses. It ran the ultimate night-watchman state of libertarian dreams: Britain had the sketchiest of police forces, let alone a health or education system. The Elizabethan Poor Law made the provision of punitive workhouses to prevent starvation a local responsibility. To maintain this Utopia Liverpool´s government was prepared to cut down demonstrators with cavalry sabres (the Peterloo Massacre of 1819 in Manchester). So it had 100% credibility in the bond market.

The RBC does not actually commend this model. Plutocracy is not a necessary condition for sustaining very high debt levels: it doesn´t apply to Britain in 1918 (175%) or 1945 (250%). But European elites are following the idea, installing banker-led governments in Greece and Italy. There is enough democracy left in both countries to make the enterprise very chancy. And modern banker austerity requires taking away rights and services the poor thought they had won, which wasn´t a problem for Lord Liverpool as he hadn´t conceded any in the first place.

2. Lend to yourself. British debt in 1815 was held by rich Britons and paid by taxes on rich Britons. The debtors and taxpayers were not identifiably distinct groups, and straddled the Whig-Tory political divide. Default is poltically attractive in two circumstances: class war (Russia in 1917) and when debt is massively held by foreigners (Argentina, every time). Another point against the moribund Washington consensus for free capital movements.

3. Borrow long. The crisis for Italy, which runs a primary surplus, has been triggered by having to roll over its debt: €300 bn out of €1.9 trn next year. This is 16% of the total, suggesting an average maturity of less than 7 years. Anti-Napoleonic Britain issued consols – undated, perpetual bonds. The rollover problem didn´t exist; the only real issue was servicing the debt interest. Vansittart wanted to retire debt with a sinking fund, following Pitt, but could not secure support for running a gross budget surplus. His successors in 1914 and 1939 issued undated War Loan bonds. The flatter the maturity profile of the national debt, the less vulnerable it leaves you to bond market vigilantes.

How did Britain make this fortunate choice? Expert input welcome. My guess is that the paradigm form of wealth was land,

an eternal asset yielding an indefinite stream of rents. The ideal

government bond was the closest substitute for land: a perpetual one.

The purchasers were very interested to secure their own and their

childrens´ social status by an assured income, and hardly at all in

liquidity. Jane Austen´s wealthy heroes are introduced with their incomes, not their assets:

Mr Bingley: ¨A single man of large fortune; four or five thousand a year.¨

Mr. Darcy: ¨his friend soon drew the attention of the room by his fine, tall person, handsome features, noble mien; and the report which was in general circulation within five minutes after his entrance, of his having ten thousand a year.¨

As BrItain´s economy shifted to trade and industry, liquidity became more important. A life insurance company for instance would not like consols, with their variable capital value, and would prefer a spectrum of fixed-dated bonds matching its liabilities. So modern finance has moved away from consols: perhaps too far.

So Jane Austen´s advice to Signores Draghi and Monti could be to convert a lot of this volatile short-term Italian debt into undated bonds. Today I suspect they would have to be inflation-proofed: the coupon is just the inflation rate plus x, where x is near zero. By definition, the ECB cannot run out of euros to meet the payments.

As a gunner in Kipling´s Western Front story The Janeites puts it:

Brethren, there’s no one to touch Jane when you’re in a tight place. Gawd bless ’er, whoever she was.

Logging you in...

Logging you in...

Loading IntenseDebate Comments...

Loading IntenseDebate Comments...

Bruce Wilder says

(Edit)

An interesting meditation on history. The foundation for British financial stability, and the instability of the French acien regime, lay in the parallel, but contrasting events of the 1720s: the South Sea Bubble and the Mississippi Bubble. The South Sea Bubble ended in the establishment of the Bank of England as a proto-central-bank, charged with managing the marketable national debt.

Just as an analyical matter, I would not oppose liquidity and income. It is the emergence of financial markets, which makes land the equivalent of “stock”, its rents the equivalent of a coupon payment, connecting land qua asset to rents as income. This leads to the emergence of the 18th century phenomenon of the improving landlord, making close calculation on turnips, steam engines and canals. A key to managing those calculations and improvements is the ability to distinguish income from mere cash flow, and for that distinction to hold, practically, requires considerable liquidity and hedging.

A marketable national debt can be a great public utility, providing a benchmark and base of “riskless” assets, against which arbitrage develops capital investment, the predictable tide of taxes and interest payments, stabilizing the value of the circulating currency. In the structure of the Eurozone, the absence of an adequate and reliable fiscal capacity would seem to be an issue that Britain did not face. Sovereign euro debt, today, carries a substantial default risk, which robs it of that usefulness, because the existence of central bank, without a corresponding fiscal authority, is not enough.

Post-Napoleonic Britain had its financial problems. The Panic of 1825 seems a parallel and precedent for 2008 in the prominent role played by the failure of the Bank of England to supervise British banks. That regulatory supervision plays so small a role in the thinking of economists on macroeconomic policy should worry us.

James Wimberley says

(Edit)

Financial markets and cash-focused landlords, chicken or egg? English landlords were enclosing land from the Tudor period, when there weren´t any financial markets, so chicken beats egg IMHO. French landlords started improving later, in the eighteenth century, to great peasant resentment – usually considered one of the causes of the French Revolution. And surely few landlords had any idea about hedging?

Frank says

(Edit)

James:

Great post!!! I was wondering about the high debt as well of the Napoleonic era that R&R left when Krugman highlighted it months ago.

Its notable that R&R start their analysis at 1820, almost as if they are trying to remove evidence from their universe that discredits their thesis…

Frank

Mitch Guthman says

(Edit)

And, above all else, borrow in your own currency. Nearly the entire crisis with Italy, Greece, Ireland and Spain is down to the fact that only the ECB can print more euros but won’t because it is willing risk another Great Depression in order to keep inflation at or below 2%.

Bruce says

(Edit)

It’s pretty common to run up extraordinarily high debts during wars, which cost an arm and a leg (sometimes literally). If you win them, you’re likely to then find your economy on the rebound afterward. War’s never really good for most businesses, after all. And, due to surges of patriotism, yes, war debts are often internal.

Rather a different case when a nation runs up massive peacetime debts, which then loom larger in the face of a shrinking GDP.

James Wimberley says

(Edit)

Except that peacetime debts largely correspond to real, GDP-enhancing assets: high speed train lines, solar and wind farms, motorways – Lisbon is surrounded with them -, technical colleges and so on. War just destroys stuff and lives, and leaves you with large liabilities for veterans´ pensions (even in 1815, for officers) and disability.

Bruce says

(Edit)

Only … not all countries run deficits because they’re borrowing to invest in infrastructure. Some just have dysfunctional politics and citizenries that don’t like to pay taxes. (And I don’t have to look overseas to point to one such.)

jim says

(Edit)

Back when I was working in a British brokerage back office in the ’60s (and, I assume, still now) 2.5% Consols and 3.5% War Loan were still traded. At the time, interest rates were much higher and they traded at steep discounts from par. Since rates today are relatively low, this would be a good time to reintroduce them

SamChevre says

(Edit)

And, above all else, borrow in your own currency.

Interesting history, and thank you! I will note that Great Britain did not, effectively, borrow in its own currency, due to the gold standard over the entire period.

Bruce Wilder says

(Edit)

Britain did not adhere to the gold standard during the Napoleonic Wars. The Bank of England was prohibited by the government from making specie payment on demand in 1797, and did not resume specie payment until 1821.

bobbyp says

(Edit)

Don’t overlook the Empire and their position as the first beneficiary of the Industrial Revolution. I’d be willing to bet their foreign trade surplus was significant, enabling them to carry that debt without a great deal of strain. The Pound was also the “reserve currency” of that era.

The eurozone crisis is straightforward: The Germans insist on having a trade surplus viz the other members of the community during an economic downturn and are unwilling to spend in order to restore balance. The inability of the deficit countries to borrow in their own currency is the cause of this crisis, a problem that the ECB could end with the simple pronouncement that it would purchase any/all eurozone sovereign debt at a price of its choosing.

James Wimberley says

(Edit)

I agree on the Empire, trade and the euro. But¨the Pound was also the “reserve currency” of that era¨? Most countries didn´t have central banks in 1815. Surely it was gold flows or nothing?

paul says

(Edit)

Well, gold and silver, but not really. Transport issues made physical flows a serious pain, so you had bills (variously discounted) moving around, with conversion into specie only as needed. Specie was what poor and middle-class people used for day-to-day commerce (when they weren’t running tabs of various kinds with merchants or employees). Which often led to local shortages or surpluses — one early money-laundering coup exchanged european paper for chinese coinage, to the unfortunate advantage of both parties.

bobbyp says

(Edit)

James,

As Bruce pointed out above, the Bank of England did not begin making specie payments until 1821. I also defer to Wiki’s entry on “reserve currency” here: “The United Kingdom’s pound sterling was the primary reserve currency of much of the world in the 19th century.”

Barry says

(Edit)

Please note that: “…primary reserve currency of much of the world in the 19th century.” could well refer to the post-1821 era.

Bruce Wilder says

(Edit)

“Reserve currency” applied to the 19th century pound sterling seems to me to involve a number of anachronisms, as has already been suggested, but, certainly, it did set a standard. Both the dominance of the pound and the international gold standard emerged gradually from a fairly chaotic system of mixed metal coinage and banknotes, and the pound and the gold standard were closely related.

After the Napoleonic Wars, Britain undertook a complete re-coinage, and began producing standardized gold coins — including the one-pound sovereign — and those coins were commonly used as bullion coins, to settle international accounts. It was in this coinage and the prestige of the pound, that the 19th century gold standard got its start. The British produced silver and copper coins as well, for circulation. The Bank of England finally got an effective monopoly on note issuance in England and Wales in 1844, and these notes were supposedly backed by gold, confirming the gold standard.

bobbyp says

(Edit)

Please note that: “…primary reserve currency of much of the world in the 19th century.” could well refer to the post-1821 era.

Well, of course. That’s the point. Look, in a gold standard system, there realistically and generally isn’t enough of the stuff to go around, and foreign holders of pounds were perfectly content to hold them as a liquid asset in lieu of some other national currency that made the same claim as to convertibility (Czarist Rubles anyone?)or even gold itself….. much like the time tested ability of banks to pull off the hocus pocus of “borrow short, lend long”. Or, why do you think the Bank of England had to borrow gold from France to stem the panic of 1825?

But really…post Napoleonic Britain managed just like we did after WWII, they grew a bigger economy over time. I also recommend JW Mason here: http://slackwire.blogspot.com/2011/08/history-of-debtgdp.html for an interesting take on this issue. I am glad to see you are not smitten with the Reinhart-Rogoff thesis. In my opinion, it is deeply flawed.